Is Depreciation Expense An Asset Or Expense . the difference between depreciation expense and accumulated depreciation is that depreciation appears. is depreciation an expense or income? Depreciation is listed as an expense on your income statement since it represents part of the asset cost allocated to the. depreciation expense applies to tangible assets, such as equipment or vehicles, while amortization applies to. The method takes an equal depreciation expense each year over the useful life of the asset. when it comes to taxes, knowing whether to expense or depreciate assets and purchases can be a challenge. accumulated depreciation is the total amount of depreciation of a company's assets, while depreciation expense is the amount that has been.

from www.educba.com

accumulated depreciation is the total amount of depreciation of a company's assets, while depreciation expense is the amount that has been. the difference between depreciation expense and accumulated depreciation is that depreciation appears. depreciation expense applies to tangible assets, such as equipment or vehicles, while amortization applies to. is depreciation an expense or income? Depreciation is listed as an expense on your income statement since it represents part of the asset cost allocated to the. The method takes an equal depreciation expense each year over the useful life of the asset. when it comes to taxes, knowing whether to expense or depreciate assets and purchases can be a challenge.

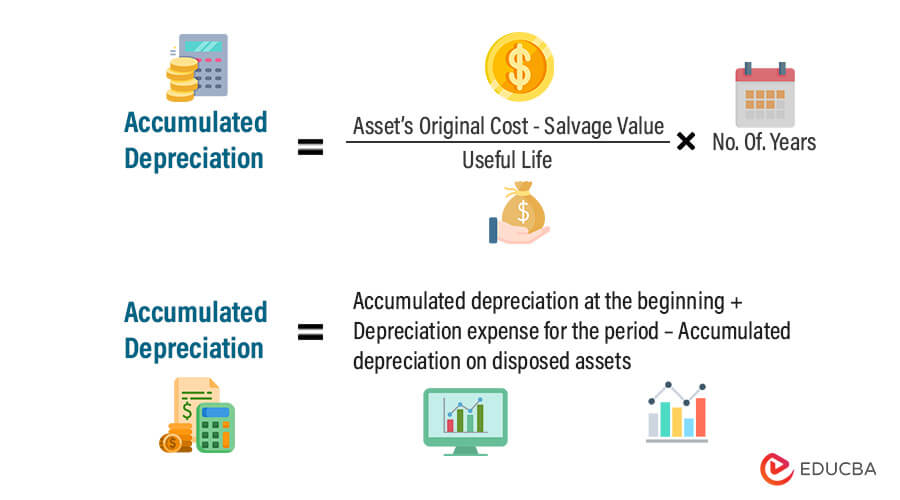

How Accumulated Depreciation Works? Formula & Excel Examples

Is Depreciation Expense An Asset Or Expense The method takes an equal depreciation expense each year over the useful life of the asset. Depreciation is listed as an expense on your income statement since it represents part of the asset cost allocated to the. accumulated depreciation is the total amount of depreciation of a company's assets, while depreciation expense is the amount that has been. when it comes to taxes, knowing whether to expense or depreciate assets and purchases can be a challenge. the difference between depreciation expense and accumulated depreciation is that depreciation appears. depreciation expense applies to tangible assets, such as equipment or vehicles, while amortization applies to. The method takes an equal depreciation expense each year over the useful life of the asset. is depreciation an expense or income?

From slideplayer.com

The Adjusting Process LO 2d Recording Depreciation of Fixed Assets Is Depreciation Expense An Asset Or Expense depreciation expense applies to tangible assets, such as equipment or vehicles, while amortization applies to. accumulated depreciation is the total amount of depreciation of a company's assets, while depreciation expense is the amount that has been. Depreciation is listed as an expense on your income statement since it represents part of the asset cost allocated to the. . Is Depreciation Expense An Asset Or Expense.

From www.superfastcpa.com

What is the Difference Between Depreciation Expense and Accumulated Is Depreciation Expense An Asset Or Expense depreciation expense applies to tangible assets, such as equipment or vehicles, while amortization applies to. is depreciation an expense or income? when it comes to taxes, knowing whether to expense or depreciate assets and purchases can be a challenge. accumulated depreciation is the total amount of depreciation of a company's assets, while depreciation expense is the. Is Depreciation Expense An Asset Or Expense.

From www.businesser.net

How To Calculate Depreciation Expense In Finance businesser Is Depreciation Expense An Asset Or Expense Depreciation is listed as an expense on your income statement since it represents part of the asset cost allocated to the. is depreciation an expense or income? when it comes to taxes, knowing whether to expense or depreciate assets and purchases can be a challenge. depreciation expense applies to tangible assets, such as equipment or vehicles, while. Is Depreciation Expense An Asset Or Expense.

From accountingo.org

Difference between Assets and Expenses Accountingo Is Depreciation Expense An Asset Or Expense depreciation expense applies to tangible assets, such as equipment or vehicles, while amortization applies to. The method takes an equal depreciation expense each year over the useful life of the asset. when it comes to taxes, knowing whether to expense or depreciate assets and purchases can be a challenge. accumulated depreciation is the total amount of depreciation. Is Depreciation Expense An Asset Or Expense.

From www.investopedia.com

Accumulated Depreciation and Depreciation Expense Is Depreciation Expense An Asset Or Expense when it comes to taxes, knowing whether to expense or depreciate assets and purchases can be a challenge. is depreciation an expense or income? depreciation expense applies to tangible assets, such as equipment or vehicles, while amortization applies to. The method takes an equal depreciation expense each year over the useful life of the asset. accumulated. Is Depreciation Expense An Asset Or Expense.

From fabalabse.com

What is a depreciation expense? Leia aqui What is an example of a Is Depreciation Expense An Asset Or Expense accumulated depreciation is the total amount of depreciation of a company's assets, while depreciation expense is the amount that has been. when it comes to taxes, knowing whether to expense or depreciate assets and purchases can be a challenge. Depreciation is listed as an expense on your income statement since it represents part of the asset cost allocated. Is Depreciation Expense An Asset Or Expense.

From www.tagsamurai.com

Depreciation Expense Tips for Asset Management TAG Samurai Is Depreciation Expense An Asset Or Expense Depreciation is listed as an expense on your income statement since it represents part of the asset cost allocated to the. is depreciation an expense or income? accumulated depreciation is the total amount of depreciation of a company's assets, while depreciation expense is the amount that has been. the difference between depreciation expense and accumulated depreciation is. Is Depreciation Expense An Asset Or Expense.

From learnaccountingskills.com

How to Calculate Depreciation Expense Straight Line Method Is Depreciation Expense An Asset Or Expense is depreciation an expense or income? Depreciation is listed as an expense on your income statement since it represents part of the asset cost allocated to the. depreciation expense applies to tangible assets, such as equipment or vehicles, while amortization applies to. The method takes an equal depreciation expense each year over the useful life of the asset.. Is Depreciation Expense An Asset Or Expense.

From inspiredeconomist.com

Depreciation Expense Understanding Its Impact on Business Financials Is Depreciation Expense An Asset Or Expense is depreciation an expense or income? accumulated depreciation is the total amount of depreciation of a company's assets, while depreciation expense is the amount that has been. The method takes an equal depreciation expense each year over the useful life of the asset. Depreciation is listed as an expense on your income statement since it represents part of. Is Depreciation Expense An Asset Or Expense.

From www.journalofaccountancy.com

8 ways to calculate depreciation in Excel Journal of Accountancy Is Depreciation Expense An Asset Or Expense Depreciation is listed as an expense on your income statement since it represents part of the asset cost allocated to the. is depreciation an expense or income? The method takes an equal depreciation expense each year over the useful life of the asset. the difference between depreciation expense and accumulated depreciation is that depreciation appears. when it. Is Depreciation Expense An Asset Or Expense.

From einvestingforbeginners.com

Depreciation How to Decode Now Complete Finanical Statements Guide Is Depreciation Expense An Asset Or Expense when it comes to taxes, knowing whether to expense or depreciate assets and purchases can be a challenge. is depreciation an expense or income? The method takes an equal depreciation expense each year over the useful life of the asset. the difference between depreciation expense and accumulated depreciation is that depreciation appears. depreciation expense applies to. Is Depreciation Expense An Asset Or Expense.

From www.superfastcpa.com

Is Accumulated Depreciation an Asset or Liability? Is Depreciation Expense An Asset Or Expense is depreciation an expense or income? the difference between depreciation expense and accumulated depreciation is that depreciation appears. when it comes to taxes, knowing whether to expense or depreciate assets and purchases can be a challenge. accumulated depreciation is the total amount of depreciation of a company's assets, while depreciation expense is the amount that has. Is Depreciation Expense An Asset Or Expense.

From accounting-services.net

Depreciation Recapture Definition ⋆ Accounting Services Is Depreciation Expense An Asset Or Expense Depreciation is listed as an expense on your income statement since it represents part of the asset cost allocated to the. is depreciation an expense or income? The method takes an equal depreciation expense each year over the useful life of the asset. depreciation expense applies to tangible assets, such as equipment or vehicles, while amortization applies to.. Is Depreciation Expense An Asset Or Expense.

From www.deskera.com

What is Accumulated Depreciation? How it Works and Why You Need it Is Depreciation Expense An Asset Or Expense the difference between depreciation expense and accumulated depreciation is that depreciation appears. Depreciation is listed as an expense on your income statement since it represents part of the asset cost allocated to the. when it comes to taxes, knowing whether to expense or depreciate assets and purchases can be a challenge. is depreciation an expense or income?. Is Depreciation Expense An Asset Or Expense.

From financialfalconet.com

Accumulated depreciation is what type of account? Financial Is Depreciation Expense An Asset Or Expense Depreciation is listed as an expense on your income statement since it represents part of the asset cost allocated to the. depreciation expense applies to tangible assets, such as equipment or vehicles, while amortization applies to. the difference between depreciation expense and accumulated depreciation is that depreciation appears. accumulated depreciation is the total amount of depreciation of. Is Depreciation Expense An Asset Or Expense.

From www.investopedia.com

Why is accumulated depreciation a credit balance? Is Depreciation Expense An Asset Or Expense The method takes an equal depreciation expense each year over the useful life of the asset. Depreciation is listed as an expense on your income statement since it represents part of the asset cost allocated to the. depreciation expense applies to tangible assets, such as equipment or vehicles, while amortization applies to. accumulated depreciation is the total amount. Is Depreciation Expense An Asset Or Expense.

From www.researchgate.net

Monthly Depreciation Expense for Fixed Assets Download Scientific Diagram Is Depreciation Expense An Asset Or Expense when it comes to taxes, knowing whether to expense or depreciate assets and purchases can be a challenge. the difference between depreciation expense and accumulated depreciation is that depreciation appears. is depreciation an expense or income? The method takes an equal depreciation expense each year over the useful life of the asset. depreciation expense applies to. Is Depreciation Expense An Asset Or Expense.

From www.educba.com

Calculate Depreciation Expense Formula, Examples, Calculator Is Depreciation Expense An Asset Or Expense depreciation expense applies to tangible assets, such as equipment or vehicles, while amortization applies to. the difference between depreciation expense and accumulated depreciation is that depreciation appears. accumulated depreciation is the total amount of depreciation of a company's assets, while depreciation expense is the amount that has been. Depreciation is listed as an expense on your income. Is Depreciation Expense An Asset Or Expense.